- Dormant Assets Consultation a Key Opportunity for Financial Education – An open letter from the Youth Financial Capability Group

Over a decade ago, the UK set up its Dormant Assets Scheme, putting assets lying idle to good use.

Since then, £892 million has been released to address some of the country’s most pressing social and environmental challenges, including breaking down barriers to work for disadvantaged young people and increasing access to affordable credit.

As the Government closes a Consultation on how the next £880m of dormant assets should be deployed, we’re calling for Financial Education for Young People to be funded. This should not be an issue; Financial Inclusion and Youth are two of the three existing priorities. What is needed is a change in interpretation of priorities and of execution. Despite the Statement of Intent (March 2018) from DCMS, OCS, HMT, DWP, National Lottery and FCA “to address Financial Capability and Financial Inclusion together”, Financial Capability and Financial Education have not yet benefitted from this funding.

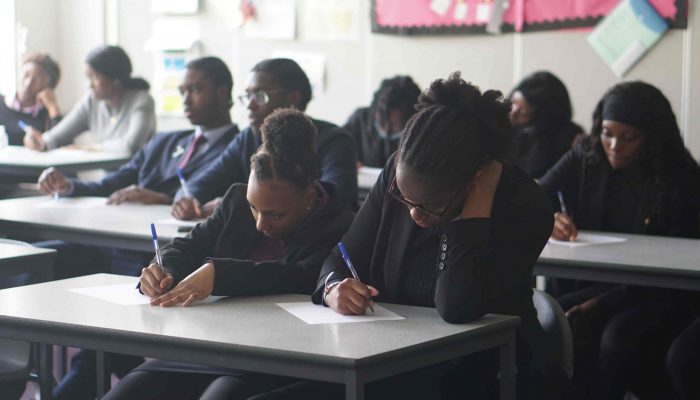

Half of young people worry they will never be financially stable. A decade of austerity and the economic fallout of the pandemic has disproportionately impacted this age group. The repercussions of poor money choices are far reaching; money links with all aspects of our lives, including our relationships with others, self-confidence and career prospects. In these challenging times for young people, building financial knowledge, skills and confidence is an investment in their future wellbeing and helps drive social change.

Effective Financial Education and collaboration with schools, youth organisations and local authorities works to improve Financial Capability and confidence. We welcome the Government’s intention to focus dormant assets on systemic change and urge them to support Financial Education for Young People.

Extra funding would allow proven interventions, such as those from members of the Youth Financial Capability Group, to scale and underpin our vision of reaching all UK 5–25 year-olds with meaningful and effective Financial Education to create a financially capable generation.

Read our full Consultation response here.