- Related Articles

- What Does A Bank Do With My Money?

- Understanding Your Payslip

- Banking

- Income Tax

- Employee Benefits

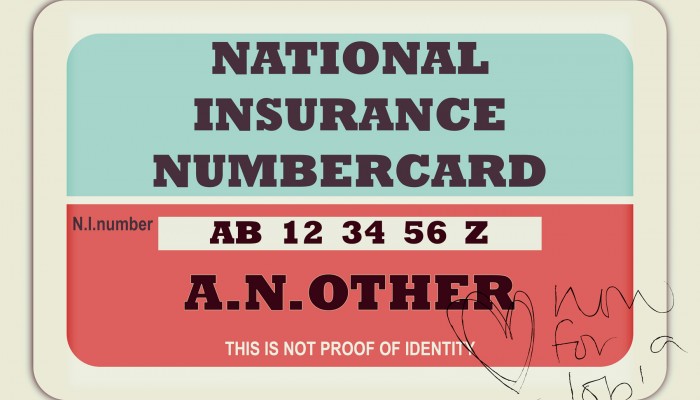

If you’re over 16 you will have received your NI number and should start to understand where your National Insurance contributions go.

What is National Insurance?

You pay National Insurance contributions in order to build up your entitlement to certain state benefits, including your State Pension.

You will be required to pay National Insurance if you are…

- Over 16 years old (you will automatically receive your NI number following your 16th birthday).

- Earning over £242 a week.

- Self-employed, making a profit over £6,725 a year.

You will continue to pay National Insurance contributions until you reach the state pension age.